Wild swings in equities have you wondering how to protect investments from a stock market crash? April 2025 has been an absolutely crazy (and stressful!) ride for the stock market.

In the span of less than two weeks, we saw:

-

A 2-day rout on Thursday and Friday, April 3rd & 4th, where the S&P 500 fell 10% – which qualified for a top-5 spot of “worst two-day drops ever.”

-

The market lurched sickeningly back and forth on Monday and Tuesday, April 7th and 8th, as investor activity reflected the oscillating rhetoric around tariff policies (which sparked the previous week’s selloff in the first place).

-

The S&P 500 jumped 9.5% on Wednesday April 9th, its largest one-day percentage gain since the financial crisis of 2008.

-

On the same day, the Dow surged more than 2,900 points, or 7.9%—its biggest daily increase ever in point terms and the biggest percentage gain since the coronavirus swept the globe in March 2020.

-

Meanwhile, the technology-heavy Nasdaq Composite soared 12.2%, its highest one-day jump since the dot-com era.

-

Markets were once again on a downward trajectory as we wrote this article on April 10th, with the S&P 500 down 6% as of 1pm ET despite the announcement that the U.S. would “pause” implementation of steep tariffs for 90 days.

-

The S&P 500 finished the week up over 5% on April 14th, its best week since 2023 (but still down from just a month earlier).

Uncertainty is high, which is one of the largest forces driving the current instability in the markets.

One particular unknown that is driving fears is the threat of a recession or market crash.

This is what you need to think through and do (or avoid) if all this chaos has you wondering how to protect investments from a stock market crash.

Key Takeaways

- Market declines are not fun to experience and when you’re going through it, it can feel like recovery from the worst just isn’t possible. But we know that markets move in cycles. They grow. They contract. And they do recover.

- The 5-year average return for the total market of US equities following 20% market declines was 11.76% between 1926 and 2019.

- If you look at where the S&P saw a 8 to 9% loss since 1926, stocks were higher 59% of the time a year later. The market was higher 82% of the time 3 and 5 years after.

- You haven’t actualized losses, unless you sell. You still own the same amount of shares that you did before April.

- If you’re invested when a market downturn begins or market volatility kicks up, then you’ve already experienced the risk of being an investor. Jumping out of the market and into cash turns unrealized losses into REAL losses, and virtually guarantees you have no opportunity to benefit from the recovery and eventual reward of a future return.

At the end of the day, for investors who are already in the market, the best way to protect investments from a stock market crash is to stay in the market.

Stick to your plan and play the long game. Give your portfolio the ability to benefit from a full market cycle, which might include a downturn… but also includes recovery and potential for future growth.

Feel the Panic – But Don’t Actually Panic!

Feeling anxious, concerned, worried, hopeless, or fearful of what comes next when markets start reacting to current events and headline news?

If you’re human, the answer is probably yes.

It makes perfect sense you’d feel this when the market suddenly becomes a highly volatile place and you see your 401(k) or your investment accounts bleeding value.

It also makes sense because you’re not just worried about the market. You’re worried about the implications of whatever made the markets start roiling.

Anxious about what it means for your job, your family, or your community. Worried about unrest, disruption, and chaos in the wider world.

Given all of the concern or anxiety around not just finances but the world around us, it makes sense that your first reaction to seeing market volatility or unrealized losses in your portfolio is to try and draw back. To do what you can to protect what you have.

You may think the best way to protect investments from a stock market crash is to get OUT of that market.

But this is where many investors start to go wrong.

It is one thing to feel what you feel, and acknowledge it. Whatever negative emotion you have right now is completely valid!

But we need to create space between what we feel and what we do.

The majority of us are long-term investors. If you can keep a longer-term perspective, then your focus will shift from current events to broader trends over decades of time.

Step one if you want to protect investments from a stock market crash?

Look at the forest that is your entire time horizon of many decades, rather than pressing your nose up against the tree of today and failing to see anything else but what’s right in front of you.

Know What It Means to Invest for the Long-Term

You might feel like you’ve been investing for many years if you started 5, even 10 years ago. But the reality is, you’re just getting started.

5 years can feel like a long time when you’re living it. When it comes to investing, though, it’s nothing.

Phrases like “long-term investor” or “investing for the long term” do not refer to 5 year periods. Double that time frame to 10 years, and you’re still not in long-term territory.

15 years? Getting closer. We’re starting to talk “long-term” once we’re looking at 20 years.

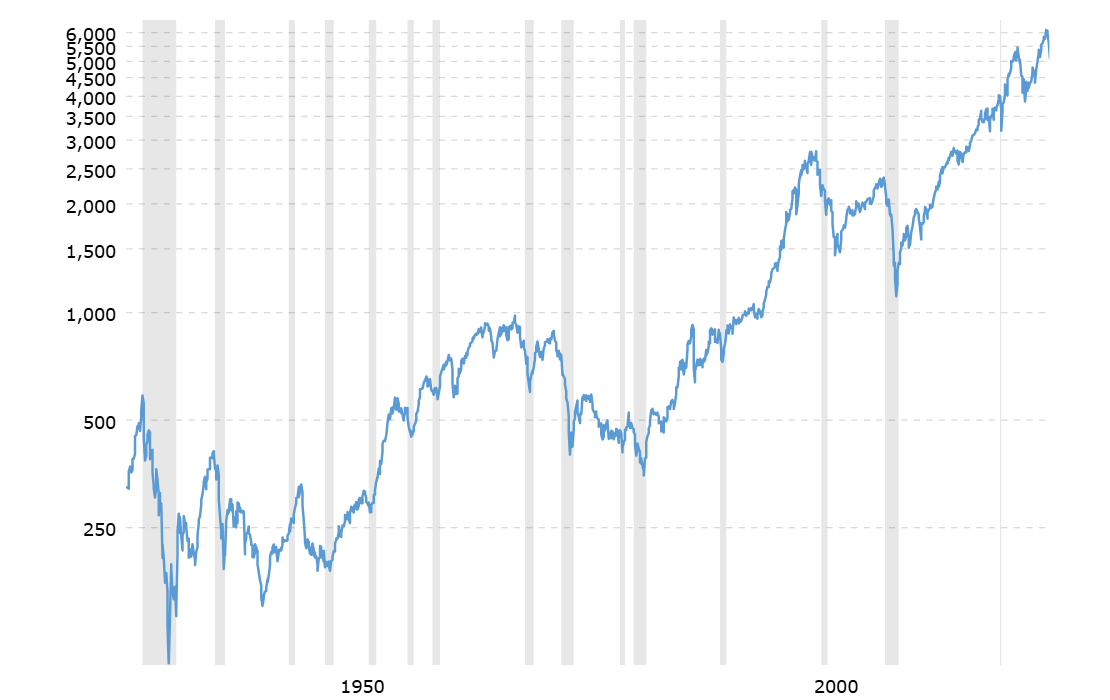

If you look at the growth of the S&P 500 over the last 97 years, the drops that happened along the way probably don’t look all that scary from this perspective:

When you zoom out, you can see that the market trended up over time.

But therein lie two core challenges for the truly long-term investor:

- We live at the END of the chart. Constantly. It’s easy to lose long-term perspective when you’re experiencing things in real-time.

- We don’t live within these data-driven charts. We live and feel the everyday realities of our lives, in the real world as one crazy thing after another happens, at the pace of one day at a time.

So much happens in a single year; the change that can take place within our life after 5 years is extreme. (The market also reacts to these things in real time, which is where you’ll see short-term volatility.)

But when it comes to our core investments made to help us grow wealth to fund our lives into the future, we have to remember that one year is a blip.

5 years is short, too. 10 years is just starting to break into a “mid-term” time horizon.

Your money won’t benefit from timing the market, but it does need time in the market. A lot of time.

Let’s look at some data to back up this claim.

The Cost of Bailing Out in an Effort to Protect Investments from a Stock Market Crash

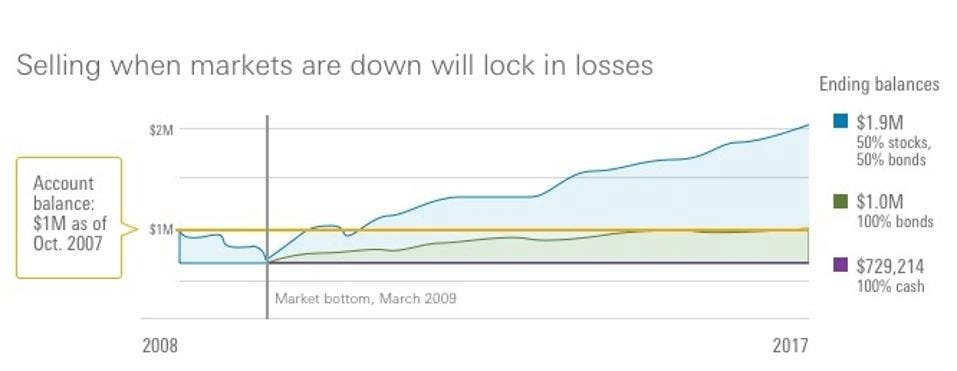

This is a great visual that shows how bad of a strategy “moving to cash” is in an effort to protect investments from a stock market crash:

Three investors started with a $1 million account balance in October 2007 – just before the stock market crash that kicked off the Great Recession.

- Investor 1, represented in blue above, started with a 50/50 allocation and made no changes. She stuck with her plan over time.

- Investor 2, in purple, panicked and moved his entire portfolio to cash. He dropped out of the market entirely in an effort to protect investments from a stock market crash.

- Investor 3, in green, dumped equities and moved into a 100% bond portfolio, thinking this was a reasonable way to protect investments from a stock market crash. He stayed in bonds, wary of getting burned again in the future.

Investor 1 – the only one focused on the fact that markets move in cycles and knew time IN the market was more important than TIMING the market – stayed in her seat.

The market rewarded her patience over time. This investor:

- Recovered the full value of her portfolio by mid-2010

- Almost doubled her portfolio balance by 2017

- Ended up with a balance that was nearly double what the all-bonds investor, and was 2.5 times greater than the investor who panicked and moved entirely to cash

Meanwhile, it took the investor who fled to bonds almost 8 years just to regain the lost value in his portfolio. He never caught up to the investor who stuck with her plan.

And Investor 2, the one who moved to cash to protect his money?

He never made that money back – but worse, and the key takeaway here, is that he was the only one who ended up with a realized loss.

In an effort to protect investments from a stock market crash, he failed to realize the crash had already happened (a very common occurance, given we don’t know where “the bottom” of the market is until we’re already climbing back up from hitting it).

The downside risk was already realized. By going to cash, he only ensured he could not take place in the market recovery or see potential for future returns.

Investors who panic and sell equities when the market is falling lock in their losses. They give up shares that, if held for the long term, are likely to rise in value in the future – which means they also lose the opportunity not just to make back their money but make more.

Trying to Time the Market Will Likely Cost You, Too

That last point is critical: trying to protect investments from a stock market crash doesn’t just require that you know when to move your money out.

That’s already virtually impossible to know until after the fact, which is what makes jumping in and out of the market so dangerous. You only need to look at what happened to the S&P 500 in early April 2025:

Between April 1st and April 11th, how would you have known with certainty, without the benefit of hindsight, when to jump out of a market generally trending upward and one that cratered within 48 hours before jumping around crazily for days after?

Not to mention, while this is a fine proxy to use when talking about “the market” generally, this is not the entire stock market. When talking about market timing, you also have to ask:

Which market are you jumping in and out of here?

U.S. equities? Bonds? Emerging markets? Europe? Because these markets do not move in tandem. Bonds got rocked the second week of April as US stocks were battered (which is highly unusual), while European markets were up.

So you need to know when you’re selling out to avoid a crash, and you have to know precisely what you’re selling out of – assuming you have a properly diversified portfolio in the first place.

Things get complicated fast. And the problems don’t stop here.

You also have to know when to get back into the market. Once you move to cash, despite the fact you’re supposed to invest for the long-term, you have to get that cash back into the market at some point.

When do you think you’re going to feel good enough to do that in the midst of all the chaos that happens day-to-day in a perfeclty normal market cycle? The reasons for waiting to invest could be endless:

- The news continues to shout about doom and gloom!

- What if a recession is just around the corner?

- I don’t know how secure my job really is (even though I have an emergency fund that’s designed to protect me in that kind of scenario and having too much cash on hand is also risky)

- We’re about to have another election; I’ll wait until after the dust settles

- Things just feel too crazy right now!

- I don’t know, the market is too high. Surely this is some kind of bubble and a crash is inevitable in the next few months.

These things are all perfectly normal to think — and they’ll also stop you from ever investing, because this list of justifications never ends. There will always be a reason to feel some degree of freaked out about the market, the state of the world, and the uncertainty inherent in the future.

Just as it’s essentially not possible to time getting out of the market accurately (without sheer luck), it is also virtually impossible to call the moment at which you should get cash into the market.

What If You Just Avoid the Worst Trading Days in the Market? (Spoiler Alert: Bad Idea)

Why does this matter? Won’t things just average out OK in the end if you avoided the worst market activity — even if it means missing on a few good days along the way?

Nope. Doesn’t work that way. Missing even a few very good days could significantly dampen the results of your long-term returns.

Try to miss the worst days in the market, and you will very likely miss the best days as well.

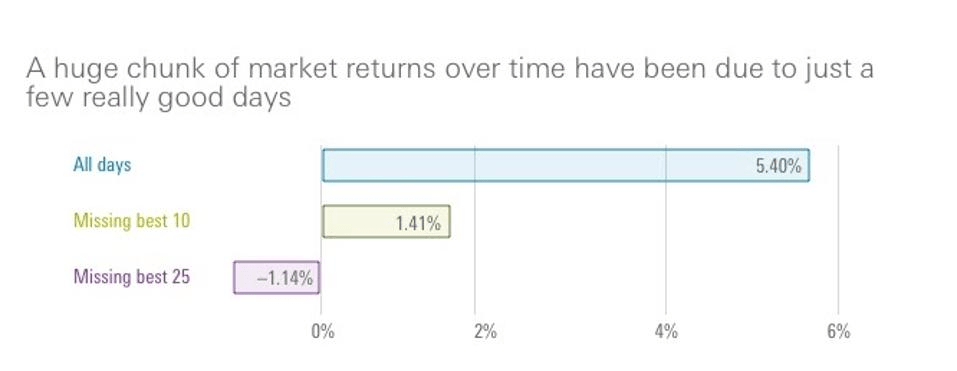

Let’s return to the data. The chart below from Vanguard shows the average return of the S&P 500 between 2000 and 2017.

(Just in case you forgot about two very bad, no good market events, S&P 500 had some really bad days during these decades thanks to the dot-com crash and the subprime crisis.)

But as Vanguard put it, “Missing the best market days would be a good way to destroy your long-term outlook.” Not exactly the goal you’re going for here.

Here’s what this chart is saying:

- If you stayed invested for all days between 2000 and 2017, your average return would have been 5.4%.

- If you missed just 10 of the best days out of 6,205 total days, you would have cut your return to almost nothing – just 1.41%, about the same as you would have expected from cash.

- If you missed 25 of the best days, you actually lost money.

Once again, the lesson from the data is clear.

Stick to your plan and stay invested for the long term.

Seek to experience all the days in the market, even the bad ones, so you don’t risk missing the best days that help provide the overall average return we’re looking for.

To Best Protect Investments from a Stock Market Crash, Stay Calm and Keep Investing

Feeling concerned about what’s going on is normal. It’s okay, and very valid, that you might feel uneasy and wonder what you can do to protect investments from a stock market crash.

The problem begins when investors act on those emotions in a way that deviates from a well-laid, strategic long-term financial plan and investment strategy.

Don’t throw your carefully-designed financial plan away when you need it most.

Riding the waves of market volatility is never fun. But remember that as a long-term investor, what looks like a mountain today will look like a molehill with the advantage of the hindsight of two or three decades.

The best way to protect your wealth is to stick around, knowing the point is to invest through full market cycles (not just parts of them). Stay invested so you can actually enjoy the ride back up.

The money in your investment portfolio isn’t there because you need it tomorrow.

It’s there because it’s working to build the wealth you need for years down the road.