How We Help

Optimize your path to

financial success

We'll guide you to your goals with an intentional plan designed for your life

BYH Wealth Management

An integrated

approach

We want you to have full control of your money, which is why we provide much more than just professional guidance and advice.

Our wealth management process collects all your competing responsibilities, goals, and dreams and sorts everything you want and need to do into a clear process.

You’ll get the right systems, the best structure, and the clearest path forward, allowing you to create the life you want, both now and in the future.

Organize and

prioritize goals

Strategize on taxes

& investments

Optimize your cash flow

Consult on decisions,

big & small

BYH Wealth Management

Here to help you grow

& maintain your wealth

Make financial choices and investment decisions you canfeel good about, with tailored attention and strategies

driven by a meaningful understanding of your goals and priorities.

- Record goals and priorities

- Establish balance sheet

- Understand cash flow

- Identify opportunities

- Develop action steps

- Optimize for lifestyle

- Strategically allocate portfolios

- Manage market risks

- Avoid costly errors

- Measure progress

- Iterate and evolve strategy

- Course-correct as necessary

- Take consistent actions

- Focus on the long-term

- Benefit from ongoing advice

Financial Planning

Use money as a tool to

enjoy what matters most

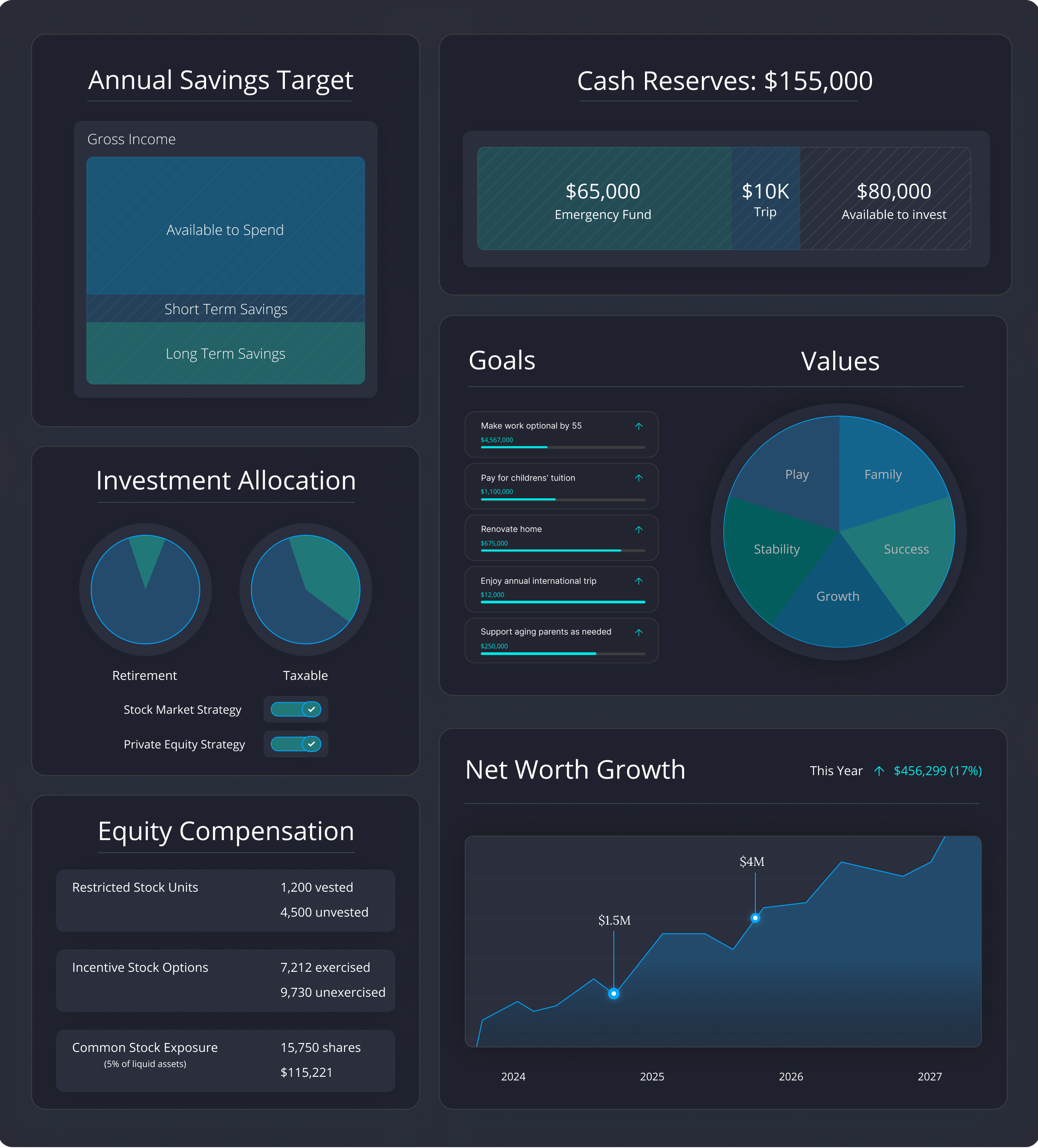

By understanding the impact of your decisions, we can empower you to make well-informed choices. We’ll help optimize your investments, reduce your lifetime tax burden, and grow your wealth - so you can use the money you work so hard to earn as a tool to get what you want from life.

As we guide you through our planning process, we’ll outline the actions needed to achieve your goals and grow your assets to support your desired lifestyle.

Financial planning covers:

- Cash flow management and analysis

- Accumulation planning

- Homebuying (or renovation) goal analysis

- Tax planning

- Employee benefits review and strategies

- Protection planning

- Equity compensation planning

- College savings strategy

- Consultation on major financial events and decisions

- ...and more. Start here to get a personalized strategy that addresses your specific planning needs

Investment Management

Delegate critical

portfolio tasks

As the engine that grows your wealth, investments should never be a guessing game. Our investment strategy, based on a globally diversified portfolio of publicly traded stocks and bonds, focuses on finding best-in-class low-cost funds to reduce fees. We use decades of evidence and research to power every decision so you can grow wealth, outpace inflation, and meet long-term goals.

We’ll also discuss alternative investments outside of the publicly traded stock market. This opens the door to private equity, credit, and real estate investments that may effectively fit within your overall strategy.

Management includes:

- Assessing risk tolerance and capacity

- Allocating assets

- Selecting investments

- Coordinating account transfers

- Trading accounts

- Rebalancing and investing cash

- Harvesting tax losses

- Accessing private markets

What You Can Expect as a Client

Smarter decisions that

drive progress

Our data-driven, personalized approach helps create a compound effect over the long-term. The

more you do correctly today, the greater your level of success is likely to be in the future.

Here are some of the metrics that matter when it comes to constructing your ideal financial plan:

Stop feeling uncertain about

what to do with your money

Everything we do is focused on helping you define your priorities

and align your finances with what's most important.

Feel more confident about your future by getting the right

strategies in place, starting with a free one-page financial plan: