Here’s our 4-step framework to help you hone in on a savings rate that’s right for you.

Most people know the importance of “saving money.” And yet, countless things get in the way of the act of saving money – including confusion over how much to save (along with where to save it and what even counts as “savings” versus what’s just delayed spending).

There are a lot of guidelines out there that aim to help you determine how much to save per year to set yourself up for a secure financial future. But most of them fall short of offering useful advice for a few reasons:

- They are often based on outdated assumptions around length of working years, retirements, and lifespans

- They encourage under-saving, leaving you short of what you need to not just get by but to thrive

- They serve as helpful starting points but aren’t tailored to your situation and goals

We can also offer a simple guideline, one that we feel is more sufficient for most people than conventional advice suggests. We recommend our wealth management clients aim to save 25 percent of their gross income each year into long-term investment vehicles.

When you’re earning into the six figures, saving 25 percent of what you earn allows you to build a healthy nest egg that can support you into the future – while also leaving you with sufficient cash flow to use on your other necessary expenses and discretionary spending.

We’ve found it’s a great place to be to balance living well today while still planning responsibly for tomorrow…

The problem is without a way of applying this guideline (even if it will keep you more on track than others) is that you could still get stuck in the “what” and “how.”

It also makes this whole question of “how much to save” a little too one-dimensional. So let’s work through our complete framework for thinking through this big, important question of how much to save.

Defining What “Savings Rate” Means

When we talk about “how much to save each year” or “what percentage of income you need to save,” we’re usually talking about how to fund your ultimate, long-term financial goal like retirement, financial independence, or early retirement.

This is separate from other short- to mid-term savings goals that you may have like buying a car, purchasing a home, or paying for college tuition.

You still need to save up for these goals, but each are more like a version of delayed spending. These dollars are not contributing to growing your wealth and therefore don’t count toward an annual savings rate.

When we’re talking about how much to save, we’ll also refer to your “savings rate.”

This is the amount of money you put toward long-term investments for growth each year.

We like to represent this with a percentage rather than specific dollar amount so that your savings is always relative to your income, even if your earnings shift up or down over time.

Which means:

If your household earns $100,000 per year and you save $25,000, you have a 25% savings rate.

If your household earns $500,000 per year and you save $125,000, then you also have a 25% savings rate (even though the dollar amount is different).

To help clarify what we’re talking about when we say “savings rate,” here is what does not count towards that figure (even though these are great things to plan for and save so you can buy or afford):

-

Money you save with the intention of spending on college tuition for a child or other family member

-

Money you contribute to a savings account for a purchase you hope to make in the near future (car, big vacation, etc)

-

Home down payment funds

-

Cash you set aside for an emergency fund

-

Money you contribute to an HSA – but then use for medical expenses, or leave in cash within the account

-

Money sitting in cash and not invested

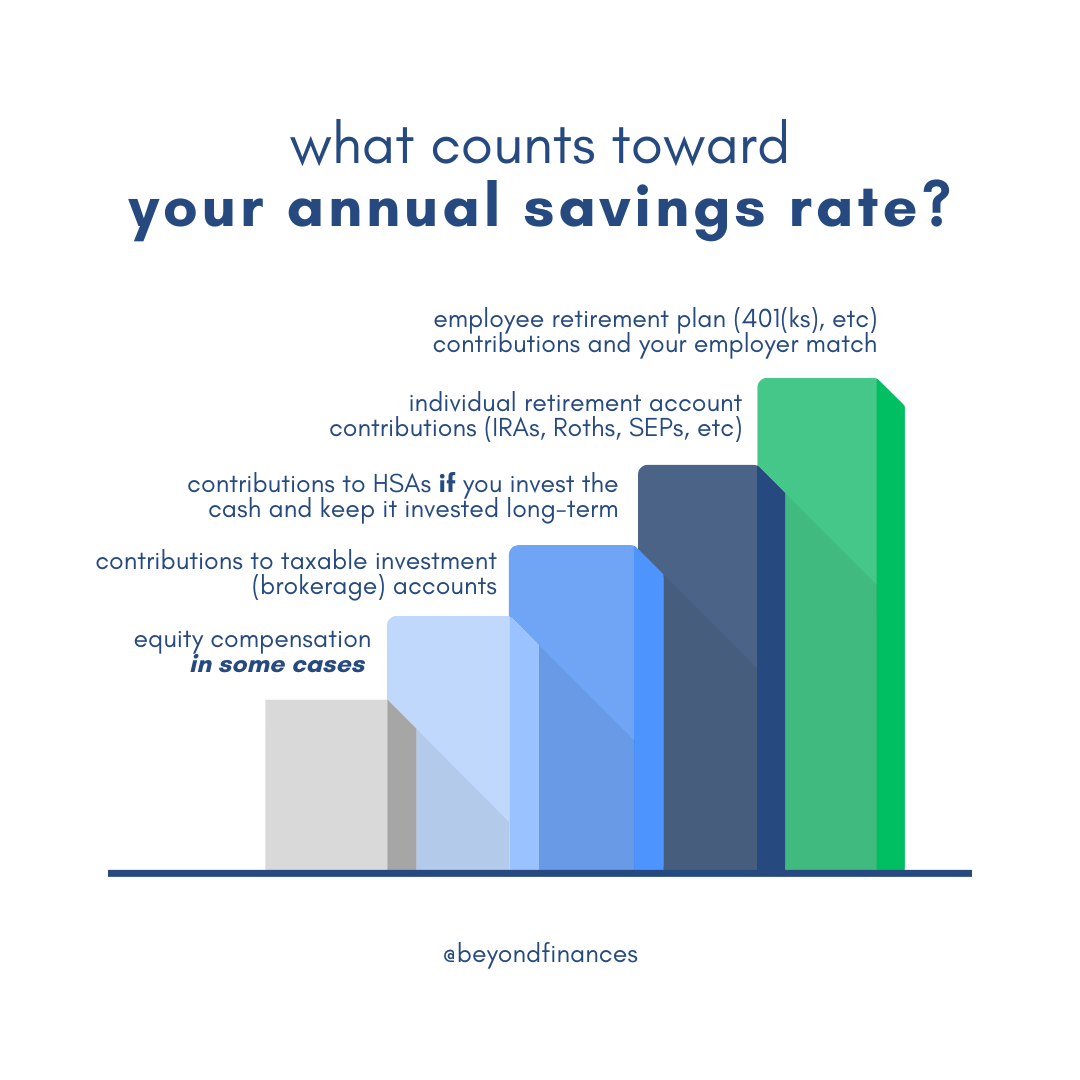

Here’s what you can count when calculating how much you’re saving per year for your own future:

Why Cash Savings Doesn’t Cut It

Ideally, any money that you are saving for the long-term (10 or more years into the future) should be invested for growth.

It’s wonderful if you have a great habit of moving money into your savings account…

But only saving by itself is likely not going to be enough to fund your lifestyle in the future.

That’s mostly thanks to inflation. Cash that’s just sitting around, not earning a return, will lose purchasing power over time.

If you don’t need the funds for current expenses, emergency reserves, or short-term goals and spending needs, consider moving that cash to long-term investments so it can benefit from compounding returns.

Now that we have some grounding in what we mean by savings rate, an understanding of what doesn’t count, and clarity on the importance of going beyond cash savings and getting that money into investments for growth…

Let’s dig into the 4-step process to help you determine how much to save and where to put those dollars to work for you.

Step 1 to Determine How Much to Save: Know Your Specific Goals

You need to know what your goals are, how much they cost, when they will show up in your life (or at least, when you expect them to do so), and how long you think they will take to achieve.

Your goals ultimately determine how much to save. They provide a clear expense that needs to be funded; knowing the cost of your goal tells you how much you need to save to achieve it.

Even the biggest goals, like financial freedom or retirement, have a price tag associated with them. The challenge is not in knowing those goals cost money to achieve – the hard part is:

- determining exactly how much it will cost you to maintain your lifestyle (what are your annual expenses for everything, from your coffee budget to your medical bills), and

- for how long (which is even harder to nail down with goals like these, since we’re essentially asking how long will you live and therefore, how many years of life will your assets need to fund).

In-depth financial planning as an iterative process will provide you with the most accurate assumptions about both of these data points. That’s the best we can get to – very educated guesses – given that how much you’ll actually spend for the next 30, 40, or even 50 years of your life is as unknowable as precisely how long your life will be.

But there are also good-enough, back-of-the-napkin math formulas you can run to at least get in the ballpark of how much your biggest goals, like making work optional, will cost.

Perhaps the simplest is to take your expected run rate (how much you spend per year in total) and multiply that by the amount of years you expect to live after you stop working.

If, for example, you want to be able to spend $100,000 per year and expect to live 30 years in your retirement, then you’d need a portfolio valued at $3,000,000 to do that.

You can also do this in reverse, using the 4% rule. Take your expected portfolio value and multiply it by 0.04, and that gives you what we assume is safe to withdraw from it every year without depleting the portfolio in your lifetime. If you had $1 million in investments, the 4% rule says you can withdraw $40,000 of that annually.

These are very crude estimates (and you can get rather tripped up – say, for example, if your $100k spending figure forgot to account for taxes!), but it at least gives you a figure to work with to help you determine how much you’ll need to achieve some of your biggest goals.

In general, the more aggressive your goals – meaning, the more expensive they are, the faster you want to achieve them – the more you need to save to fund them.

If you have very modest goals, focus in on the 10 to 20% range. As your goals get more aggressive, you need to start focusing on the 20-50% part of the spectrum. If you’re aiming for something very ambitious that will take large amounts of assets to support, your rate may need to be 50% or above.

Step 2: Set Realistic Expectations Around Investment Returns (and Don’t Expect Your Investments to Make Up for Lack of Savings)

Because this is long-term money, we assume any money that’s part of your annual savings rate is going to a long-term investment account, like a retirement or brokerage account.

This is money that you will invest today and leave invested for 15, 20, or more years.

Based on that, you should be able to expect some amount of return on that money. You don’t have to do all the heavy lifting to get to an ultimate goal achievement number.

Your money is busy earning more money, too.

But be careful how much money you assume you’ll get from your investments. You want to consider a savings rate that will work for you when combined with a reasonable expected rate of return from your investments.

We feel 5 to 7 percent is a good range to consider if you’re looking at the long-term.

Don’t rely on extremely aggressive investment expectations to determine how much you need to save. If you assume you’re going to get a 10-12 percent return, you likely won’t save enough because you’re banking on that (unrealistic) rate of return.

The more you save, the less risk you’re forcing yourself to take.

And the more you save, the less you have to rely on external factors that you can’t control (i.e, market performance).

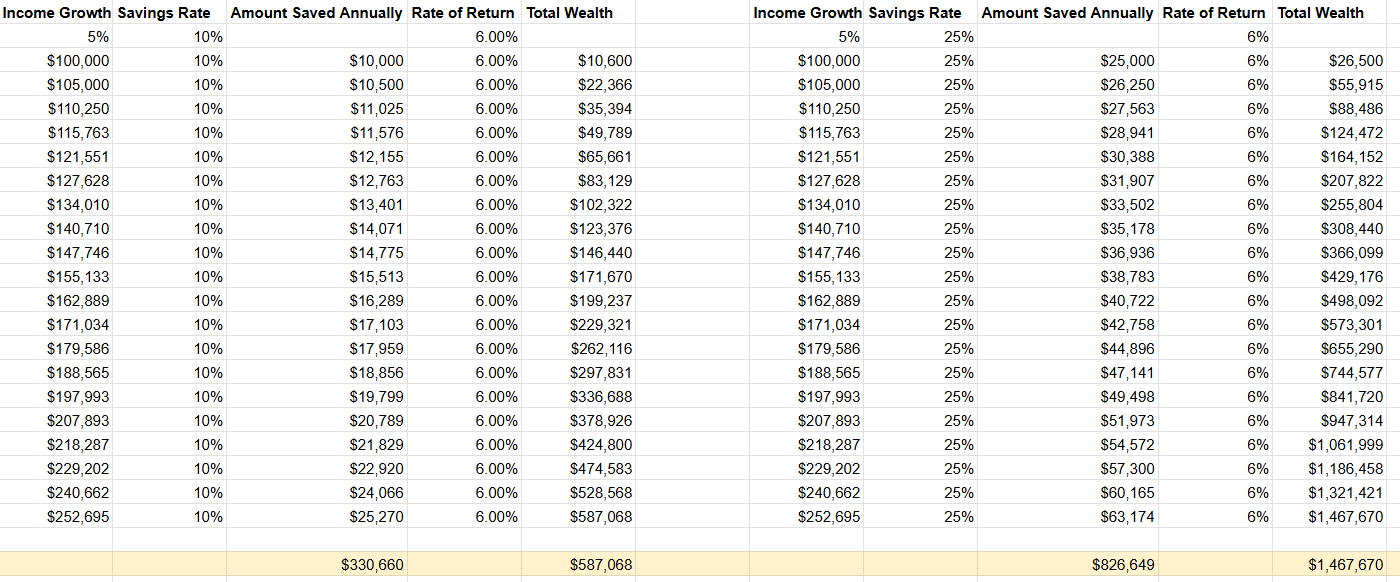

To show you how powerful your savings rate is, take a look at the chart below. This compares two theoretical households with similar income growth of 5% a year and the same average rate of return (6%) for their investments.

The difference? The household on the left saves 10% of that income per year. The household on the right saves 25%. Take a look at that bottom highlighted line to see how that plays out over 20 years:

The household on the right accumulates more than $1.4 million over a 20-year period. The household on the right, however, barely has more than $500,000.

The difference is in their savings rates.

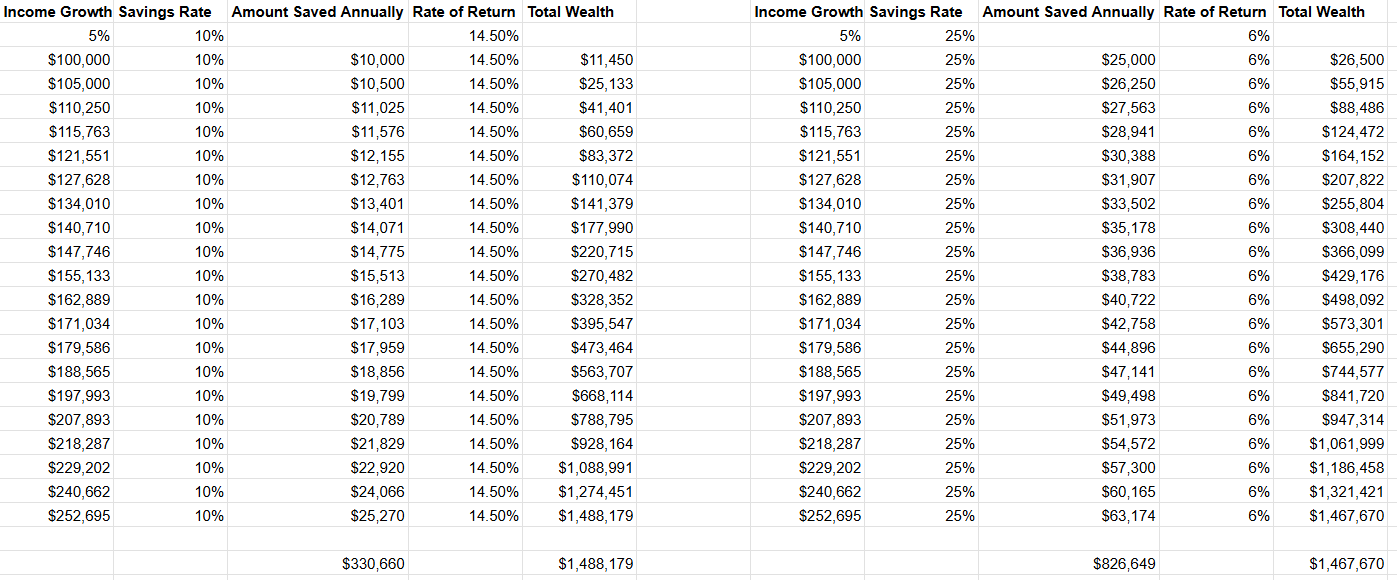

Even if the household on the left earned better investment returns, it would be almost impossible to catch up to the household on the right if they left their savings rate at 10%.

The household on the left would need to earn a whopping 14.5% average return in the market to keep up with the household on the right in terms of total wealth accumulation over 20 years:

Spoiler alert: getting an average return of 14.5% over 20 years is extremely unlikely to happen.

You’d have to take on an incredible amount of risk to even have a shot at these kinds of numbers, which means you increase your chances of losing money when the point is to make it.

The household on the right in the chart, meanwhile, only needs a modest 6% average return thanks to their strong savings rate – which is much more realistic and reasonable to assume.

The control you have is your savings rate. Take advantage of that!

Step 3: Prioritize Consistency and Sustainability When Deciding How Much to Save

When considering how much you need to save, keep in mind this is something you need to do year over year over year – for decades of time.

It can be overwhelming to think about it that way, but that’s the reality we all face when we need to build our own wealth: this is a marathon, not a sprint.

That means we need to settle into a pace we can sustain and remain generally consistent with over time, even as goals shift, priorities change, and life evolves.

That big-picture, longest-term goal of “financial stability” – whatever that looks like to you – is probably the most static, concrete goal you can have even as everything else is in some degree of flux or development or change.

So to keep on track to meeting that goal, we have to maintain a consistent savings rate for it… despite all else that might come up in life.

This leads to two suggestions when deciding how much to save per year:

- Save more than you think you need to when you can – especially if you’re younger and have the advantage of time. Time in the market gives you the most opportunity to take advantage of compounding returns, so this is a good reason to “front load” your savings and be as aggressive as possible when you are in your 20s and 30s (and likely have fewer expenses/responsibilities than you will have in your 30s and 40s as you mature in your career, grow your family, and add more complexity to your financial planning).

- Be realistic about your own financial situation when setting a savings rate. Going to extremes is usually not sustainable for most people, and it’s more important to find a moderate level of savings that won’t leave you feeling burnt out or extremely deprived than it is to save the absolute most you possibly can. You might think it’s doable to save 50% of your income when you look at everything on paper – and you could be right in that it’s possible. But it might not be practical if the reality sees you turning down opportunities or experiences that you won’t be able to get back later in life for the sake of throwing a few extra dollars into your investment account.

You can always increase your savings rate as you go and gain confidence in what you are capable of managing and achieving.

Step 4: Allow Other Sources of Income to Temper How Much to Save

This framework wouldn’t be complete without considering this last item – but be careful in how much you rely on it. When making assumptions and long-term planning projections, there’s a fine line between factoring in likely-but-not-guaranteed information and making unrealistic predictions about the future.

With that caveat, when setting your savings rate, it’s worth considering if you can include other forms of financial support into your plan beyond just what you can save on your own.

Some people will have other sources of income than their own savings in the future, and that will impact how much they need to save. For example, you could:

- Have an inheritance that you feel confident you’ll receive

- Be able to leverage a pension from work

- Expect Social Security to replace a large percentage of your current income

…or some other circumstance that will allow you to receive some form of income even after you stop working. If that’s true in your situation, then your savings rate right now might not have to be so high given that you will have other forms of financial support to rely on down the road.

That doesn’t mean save nothing! It’s still important that you build assets that you control, rather than relying entirely on external sources.

How Much to Save: Honing in on a Specific Rate for Your Situation

Our general recommendation to our wealth management clients is to save 25% of their gross income. If they can do that consistently over the years, we have good confidence that they’ll be able to afford their lifestyles now while also building the assets required to support those lifestyles in the future too.

When choosing your own savings rate to help you determine exactly how much to save, remember that:

- Your savings rate is what you save of your gross income

- Your savings rate should be set as a percentage, not a dollar amount; this keeps your savings relative to your income and helps guard against lifestyle inflation

If you are currently saving less than 10% of your income, that’s unlikely to be sufficient to get you to a secure retirement (and will almost certainly disallow you from bigger financial goals like early retirement or making work optional).

If you’re saving between 10 and 15% of your income, this is a good starting point – especially if you’re new to building a savings habit, making less than $100,000 per year, or if you’re hitting this range of savings consistently year after year after year.

This could likely afford you a modest retirement, but early retirement is still probably out of reach at this level of savings (unless you’re defining “early” as something in your late 50s or early 60s rather than age 67 – in that case, if you’ve been saving 15% of your income every single year since you started working, this might be possible depending on the health of your investments and your personal expenses).

Saving 15 to 20% of your income is what we see as the absolute minimum for anyone earning six figures or more, while 20-25 % is our starting guideline for our clients.

If you earn $250,000 or more, saving 25% of your income should be achievable and we recommend aiming for this benchmark.

Once you start saving more than 25% of your income, you begin building serious flexibility, freedom, and choice into your financial plan (especially if you’re younger and can maintain this rate for years or over a decade-plus).

But even a savings rate of 25-30% may not be sufficient if you’re chasing truly aggressive financial goals, like very early retirement in your 30s or 40s. For that, you likely need to push your savings rate to 40-50% to achieve an early retirement goal within 10-15 years.

That being said, here’s what we’ve seen from experience:

Most people don’t want to completely retire, especially so young. Most of our clients want more freedom and flexibility, but they also value and enjoy their work.

“Making work optional” is a much more popular goal, and usually means creating a plan that can work if clients change roles, and accept lower pay for more time, autonomy, or work they simply prefer but doesn’t pay as much.

From what we’ve seen when creating financial plans for 30 and 40-something professionals, a savings rate between 25 and 35% (depending on incomes, expenses, and timelines, of course!) is the sweet spot for how much to save to meet a make-work-optional goal.

Prefer this in podcast format? Here’s the original episode we recorded on How Much To Save: