Have you considered a high deductible health plan, or HDHP, as an option for your health insurance? It might be worth switching to one so you can use an HSA account.

An HSA account is a health savings account — meaning, it’s a place that allows you to save and even invest money specifically for the purpose of handling medical bills and expenses in a way that can save you on taxes.

But there’s a bit of a catch:

Many people shy away from using an HSA account because you have to have that HDHP first.

And most folks don’t like plans with high deductibles because if you go to the doctor’s office often, require procedures not considered “preventative care”, or end up in the hospital overnight, you may be on the hook for paying thousands of dollars out of pocket before your insurance steps in to cover additional care or treatment.

But my wife Kali and I both deliberately choose to carry HDHPs for health insurance for two main reasons:

- The monthly premiums are lower

- HDHPs give us access to those very important health savings accounts

We can take the money we save on the cost of premiums and put that cash into an HSA account instead of handing it over to the insurance company.

So why is an HSA account that advantageous — enough to outweigh the fact that we carry high deductibles and might pay so much out of pocket?

Because we plan on using it as a tax-efficient way to help pay for the inevitable cost of healthcare in retirement.

Here’s how (and make sure to read all the way to the last section of this post to see how less than $300 per month can turn into over $300,000 worth of tax free cash to use on healthcare).

Why Health Savings Accounts Offer Big Benefits to People Who Use Them

First, you need to understand exactly what an HSA account can offer you. The biggest thing? HSAs are incredibly tax-efficient and offer three specicfic tax advantages:

- The money you contribute to your HSA account is tax-deductible, meaning you can deduct the amount you put into an HSA from your taxable income in that year (this may happen automatically through an employer plan).

- Once your money is in your HSA, you can invest it — and you don’t have to pay taxes on your capital gains and dividends.

- As long as you use the money on qualified healthcare expenses, you don’t pay taxes on the money you take out of an HSA, either.

Tax-free growth and spending is already a pretty sweet deal. But there’s even more value here if you know how to use an HSA account the right way.

Consider this:

Healthcare will likely be your biggest expense as you age. A couple in their 60s today can plan to spend almost $300,000 on healthcare alone between now and when they die.

So if you can…

- Contribute to an HSA account now

- Invest those contributions

- Leave that money in the account and let it grow until you reach your 60s or 70s

…then you could get a tax break today, a tax break on your investment earnings, and have access to a pool of tax-free funds to use on healthcare when you’re likely to need it most: in retirement, or in your later years.

How We Leverage an HSA Account to Our Advantage

That’s exactly why Kali and I chose HDHPs so we could use HSAs. We max out our contributions each year; for 2019, the maximum is $3,500 if you file your taxes as single or $7,000 if you’re married and file jointly.

Our plan is to keep that money in the HSAs as long as we’re working. If we want to have a a substantial funding source that we can dedicate to taking care of our healthcare expenses later in life, then we need that HSA money working for us (meaning, earning compounding returns over decades of time).

To take full advantage of the account, we’re investing our contributions and then keeping those funds invested to make the most of compounding returns.

If you take money back out, even to pay for medical bills you incur today, you limit its ability to grow over time.

When we face healthcare costs we need to pay now, we fund those expenses through other means. Usually, this is just through our regular monthly cash flow; if we need to pay a $50 co-pay to see a doctor, it comes out of the budget (and it may mean one less dinner out that month to make up for it).

But bigger bills mean finding other sources to cover costs — like we had to do last summer, when Kali had a severely atypical mole that could have progressed to melanoma if not removed from her leg.

Between office visits, an initial biopsy, several pathology tests, visits to a dermatological surgeon and a procedure to have even more cells removed from her leg (to make absolutely sure there were no cancerous cells present), plus all the follow-up visits after her procedure for additional wound care from the incision site…

We spent well over a thousand dollars on bills our high deductible health plan didn’t cover.

(Here’s Kali’s leg immediately after the surgeon finished up. She was not happy to find that a little mole could lead to a full leg wrap she had to keep on for weeks!)

But instead of pulling money out of the HSA account, we used a combination of money from our monthly budget and our cash savings to pay for her medical expenses.

That allowed the money invested in Kali’s HSA account to continue to grow (and remember, that’s tax-free growth — which is a pretty hard deal to find anywhere else).

Is Keeping Money in Your HSA Account Worth It?

Again, as long as we’re working and earning incomes, we plan to pay for healthcare costs from what we earn. When we quit working (or choose to work less and perhaps earn less later in life), then we’ll pull from the HSA account to cover these kinds of costs.

But still, it is tempting to pull from that pile of money that’s already set aside for these kinds of costs. It would be so much easier in the short-term to cover the bill with HSA money instead of using money from our budget — because diverting money from today’s budget also means spending a little less today.

If you’re tempted to do this — to use your HSA to pay for medical expenses now instead of banking those funds for later — lets run through some of the numbers to see what happened if you let that money stay invested instead.

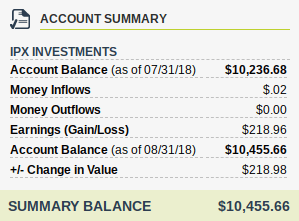

We can use Kali’s HSA account as a real-life example. This is a screenshot of her account as it was when she had that medical procedure last summer:

She’s used an HSA account for 2 years and 9 months, and she maxes it out each year. That means she’s contributed $9,337.50 since January of 2016.

The majority of the value of her HSA came from the money she contributed herself because of the relatively short time the account has been open and funded.

Remember, when we talk about investing, even 3 years is a short time frame. We want to think in decades, not just years.

The longer Kali keeps these funds invested — and continues contributing to them, as well, the more value she’ll see in the HSA over time. Still, even over a 3-year period, her investments are helping out: they’ve earned $1,118.16 on their own.

That $1,118.16 earnings equates to a total return of 11.97%. Of course, we’ve also seen a very, very long bull market over the last decade, so we may not experience this type of return forever.

However, as with all investments, when it comes to an HSA account, it’s not market timing that counts. It’s time in the market.

Although there are no guarantees (the HSA investments can lose money), if she continues to invest without taking money out, she can expect to see her money start earning more and more money on its own.

Things start to get a lot more exciting if we look at what can happen if Kali continues to contribute even just $287.50 per month (which was what she contributed in 2018 to hit the then-maximum of $3,450; that maximum has already increased, so she gets to contribute more this year and into the future).

If she contributes that amount until she’s 65, which is 36 years from now, here’s what happens:

- Current Balance: $10,455.66

- Monthly Contribution: $287.50

- Length of Savings Period: 36 Years

- Rate of Return (compounded annually): 4% (this is a relatively conservative rate of return over 36 years)

How much could her HSA account have if she keeps her contributions invested, and continues to save into it until she needs to use it for healthcare expenses after she stops working?

$310,623.51 — or a little more than she should expect to need to spend from the time she hits her mid-60s until the end of her life.

And all that money, should she use it on qualified health expenses, lowers her tax burden as she saves it and allows her to spend tax-free when she does withdraw it in the future.

That’s the power of an HSA account if you know how to leverage it properly — and if it fits within the context of your larger financial plan.

An HSA isn’t right for everyone, and you absolutely need to be prepared to handle the cost of a high deductible should you need to see the doctor more often than you initially planned to do. But if you have a health savings account and want to make the most of it, this is a good strategy to consider.