Wealth Management,

Done Mindfully

Enjoy the present because you've

taken care of the future

50+ years

Team experience helping

proactive wealth-builders

$146MM+

Assets under

advisement

300+

Self-made millionaires & high-

achieving families served

Your money is a tool

to build your ideal life

Get an ongoing process that helps you make well-informed, intentional decisions about today and tomorrow.

We're here to help business owners and motivated professionals realize their unique visions for success. We'll be your guide through a collaborative, integrated, and strategic financial planning process designed to take advantage of your opportunities while minimizing downside risks.

Your money also needs to work for you in your actual day-to-day life. Using our process means getting to enjoy more of what you want right now, while still planning responsibly for tomorrow.

With our guidance and coaching, you can achieve your specific vision while growing your wealth.

For business owners & professionals earning equity comp

Wealth management for motivated professionals

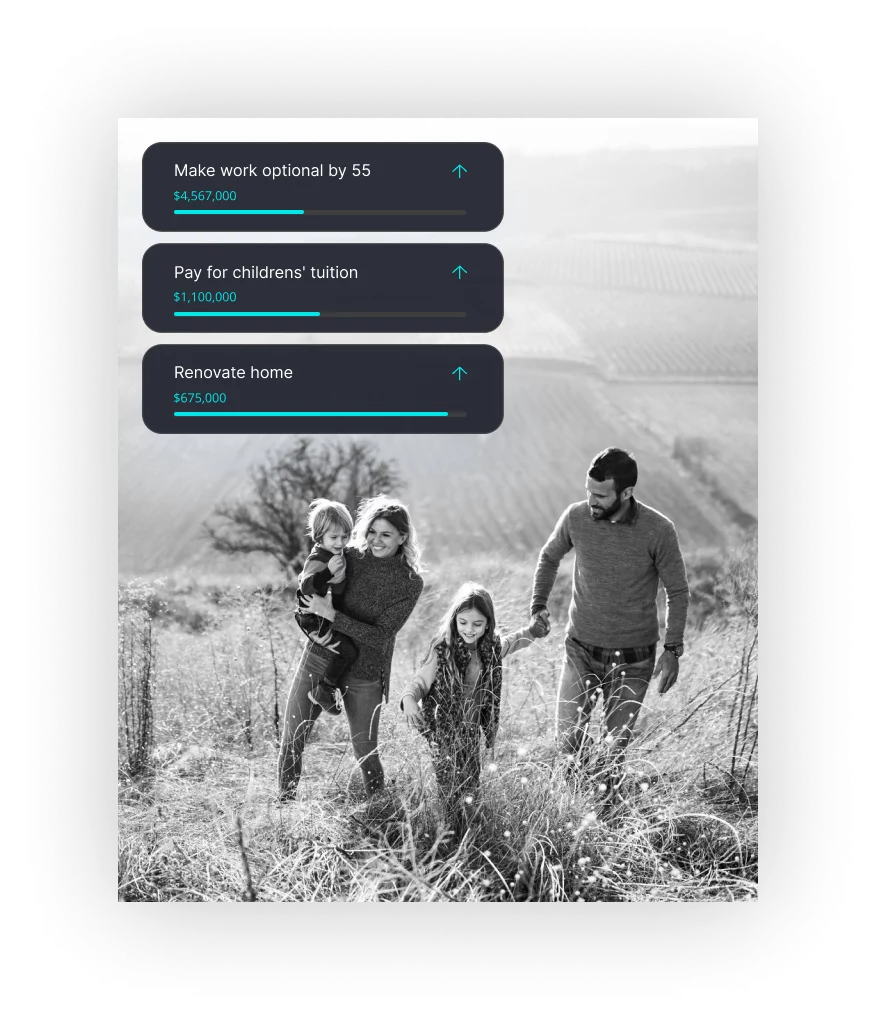

BYH helps those navigating their career while establishing wealth, experiencing major life transitions, and growing families.

You want to implement a strategic approach that considers all aspects of life, not just finances - and one that allows you to live well today while still planning responsibly for the future.

Who we work with:

- Couples in their 30s or 40s with $500,000 or more in household income

- Business owners who want support and clarity around financial decisions, especially as your life expands and things feel more complex

- Employees with complex compensation structures; your earnings may come from a combination of wages, bonuses, commissions, and equity compensation

- Good savers with cash balances that you know you need to invest wisely to grow wealth

- Professionals who value being proactive and having a plan - and love executing once you have a specific strategy to follow

- Folks who want to strike a balance between enjoying life now while also growing wealth for a financially secure future

5 Strategies to Optimize

Your Finances

Are your finances set up to help you achieve what you want from your life? Don't leave it to chance.

Download BYH's ebook and ensure you're taking advantage of available opportunities to grow your wealth.

Guidance to maximize your financial potential

Fee-only fiduciaries

As an independent, fee-only firm, we don’t sell products, earn commissions, or receive kickbacks from third parties. We’ve removed financial incentives and, as fiduciaries, have a legal and ethical obligation to always provide unbiased, objective advice that is in your best interest.

There are no hidden fees, and part of our investment due diligence process is to select from best-in-class low-cost funds. That allows you to focus on results, not second-guess how you’re paying your advisor.

Expert guidance

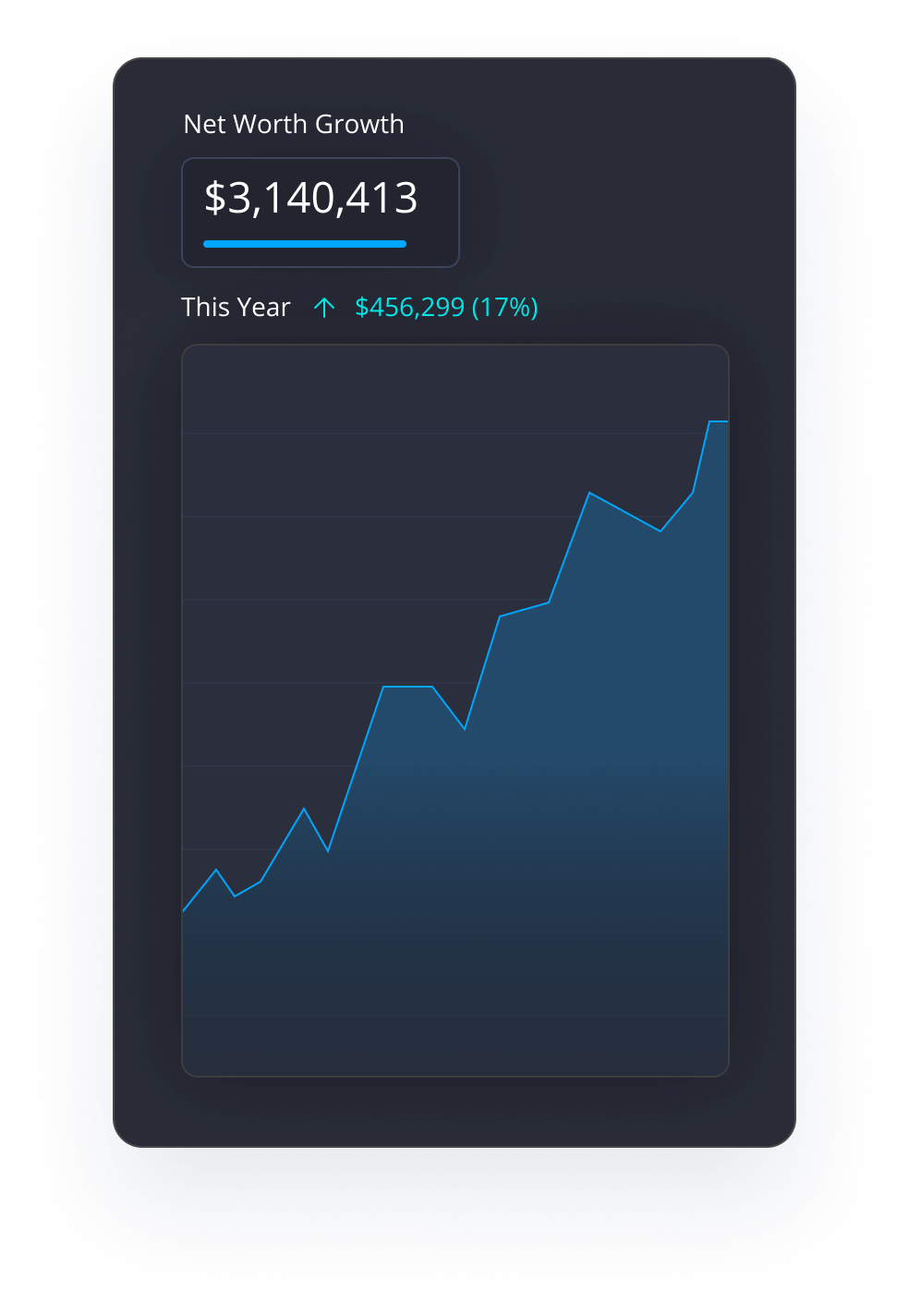

With BYH Wealth Management, you get access to a proven financial planning framework and investment management strategy to build your assets and grow your net worth. Our goal is to provide you with the right system to maximize your financial potential so you can actually enjoy what you work hard to build. Together, we can:

- Identify and prioritize what matters most to you

- Get the most value from your cash flow

- Create an investment strategy to achieve financial freedom

- Implement the right actions to create significant wealth

- Enjoy the ability to use your time the way you want

Dedicated service team

You could follow the green line to a national corporation’s cookie cutter approach to financial management and get lost in the shuffle of call center transfers – or you can collaborate directly with a tight-knit team of committed professionals who know who you are and understand what you are looking to accomplish.

We focus on serving an exclusive group of clients so that each of our team members can give you the necessary time and attention to meet your needs as life happens. You can rely on specific answers to your questions – answers that consider the context of your unique circumstances.

Consistent, ongoing support

True financial planning is not a one-time event. It’s a comprehensive, ongoing process that helps you continually get the most from your money.

We don't hand you a stack of documents and spreadsheets and call it a plan. If there’s one thing we can guarantee, it’s that things change. Your wealth management strategy should evolve and change, too, which means you need a planning relationship as dynamic as your life.

Real-world tested

Just knowing the optimal strategy doesn’t matter much if you aren’t also taking the actions necessary to move your plan forward. Acting on the advice you get requires confidence that you’re doing the right thing for you, which is why we not only provide guidance on next steps, but take time to explain the why behind every decision.

Our ability to translate financial jargon into practical advice – and create plans that actually work in the real world – comes from leading hundreds of conversations each year with people who are going through the same phases of life and working with the same financial challenges and opportunities that you are. We serve a specific group of likeminded clients so that everyone can benefit from the collective knowledge that accumulates after seeing these scenarios unfold time and time again.

Request a free financial review

Our financial planning process and investment management strategies that provide a realistic path for achieving what's most important to you. Together, we'll collaborate to create a customized roadmap from where you are today to where you want to go tomorrow.

Ready to take control of your money, gain clarity on what's next, and grow your wealth?