How We Help

Optimize your path to

financial success

We'll guide you to your goals with an intentional plan designed for your life

BYH Wealth Management

An integrated

approach

The BYH Wealth Management program combines financial planning and investment management strategies to give you full control of your financial situation. By implementing a cohesive action plan, you can develop the financial means to create the life that you want to live, both today and tomorrow.

We provide our clients with not just professional guidance and advice, but an ongoing, organized process and clear framework for making smarter money decisions. It's these optimal decisions that allow you to create, grow, and keep more wealth.

Goal Planning

Cash Flow Optimization

Tax Planning

Investment Management

Equity Comp Strategies

Big Decision Consulting

BYH Wealth Management

We know how to create wealth

Make financial choices and investment decisions you canfeel good about, with tailored attention and strategies

driven by a meaningful understanding of your goals and priorities.

- Record goals and priorities

- Establish balance sheet

- Understand cash flow

- Identify opportunities

- Develop action steps

- Optimize for lifestyle

- Strategically allocate portfolios

- Manage market risks

- Avoid costly errors

- Measure progress

- Iterate and evolve strategy

- Course-correct as necessary

- Take consistent actions

- Focus on the long-term

- Benefit from ongoing advice

Financial Planning

Use money as a tool to enjoy

what's most important

The purpose of financial planning is to empower you to make well-informed and mindful decisions because you understand the impact of your choices. This allows you to truly use money as a tool not just to build your wealth over time, but also enjoy life along the way.

When we guide our clients through our planning process, we develop financial strategies that outline the actions to take to achieve specific goals and grow assets that can support a desired lifestyle in the future — while fully enjoying important experiences in the present.

Financial planning covers:

- Cash flow management and analysis

- Accumulation planning

- Homebuying (or renovation) goal analysis

- Tax planning

- Employee benefits review and strategies

- Protection planning

- Equity compensation planning

- College savings strategy

- Consultation on major financial events and decisions

- ...and more. Get a strategy for your specific planning needs by scheduling a complimentary consultation here

Investment Management

Delegate critical portfolio

management tasks

Our investing strategy is based in a globally-diversified core portfolio of publicly traded stocks and bonds. We then target dimensions of higher expected returns using decades of empirical evidence and research to power every decision - so you can grow wealth, outpace inflation, and meet long-term goals.

Our team of CFAs performs in-depth periodic research on global asset classes to ensure that we're choosing the appropriate exposure to each, through the right investment vehicle inside your portfolio.

As your accounts grow, we also discuss alternative investments outside of the publicly traded stock market. This opens the door to private equity, credit, and real estate investments that may fit within the context of your overall strategy.

Management includes:

- Assessing risk tolerance and capacity

- Choosing asset allocation

- Selecting investments

- Coordinating account transfers

- Trading accounts

- Rebalancing and investing cash

- Target dimensions of higher-expected returns

- Harvesting tax losses

- Accessing private markets

What You Can Expect as a Client

Smarter decisions, more progress

By making data-driven decisions and optimizing your financial choices (while also avoiding big money mistakes), you create a compound effect over the long-term: the more you do correctly today, the greater your level of success is likely to be in the future. The adjustments we'll show you how to make throughout your financial life today can add hundreds of thousands of dollars to your net worth over your lifetime.

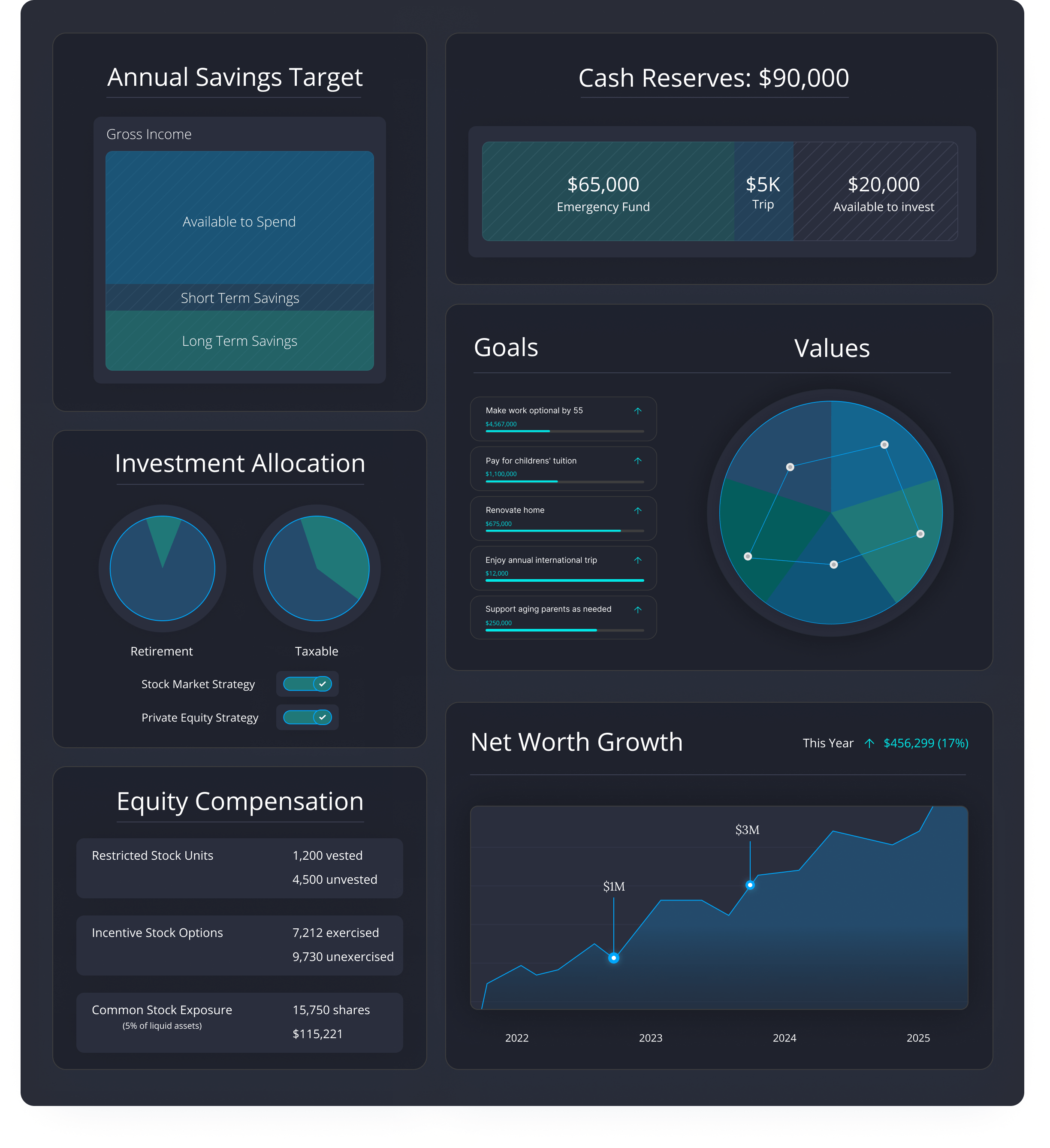

Here are some of the metrics that matter when it comes to constructing your ideal financial plan:

Stop living with uncertainty about

what to do with your money

Everything we do is focused on helping our clients define their priorities and align their finances with what's most important. Feel more confident about your future and request your free one-page financial plan here:

Wealth Management That Works

Optimize your finances - grow your wealth

Our Wealth Management program is designed for business owners and employees with equity comp who want a custom-designed strategy to organize their finances, prioritize their goals, and grow their assets.